Written by the Market Insights Team

7 min read

Jobs, jolts, and July: The Fed’s cut gets closer

Antonio Ruggiero

As more US macro data rolls in, it’s the labour market – more than any other sphere of the economy – that’s starting to offer the most cohesive picture of a slow-cooking US economy, weighed down by a forceful protectionist agenda and clouded by deep uncertainty.

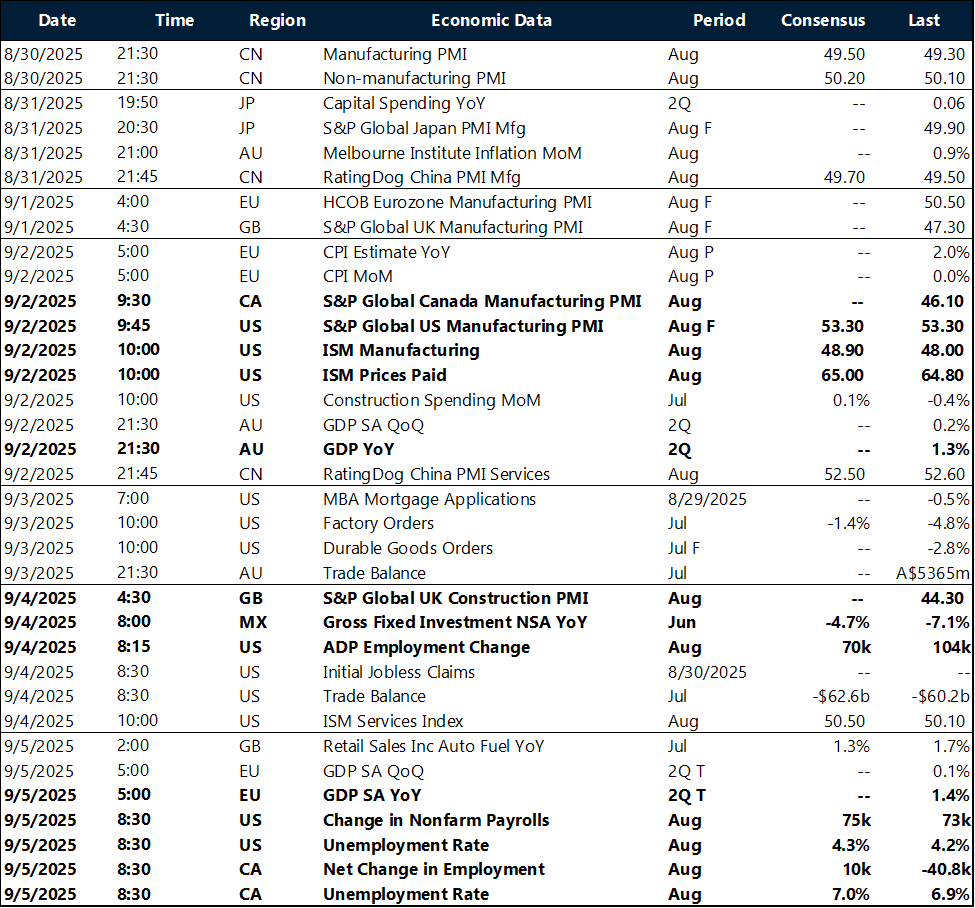

Job openings fell to 7.181 million in July, down from a downwardly revised 7.357 million in June (consensus: 7.380 million). The report also showed a notable uptick in layoffs, rising to 1.808 million from 1.604 million previously, with revisions lifting the prior figure to 1.796 million – underscoring a clear shift in trend.

Markets responded swiftly, filling in that residual gap to the bream: from 20 basis points of a cut previously priced in, the move to 24 bps leaves just a 1 bp discrepancy – signaling that expectations for a Fed rate cut this month have never been higher.

The continued decline in the quits rate, also, points to easing wage pressures. Fewer voluntary departures – driven by economic uncertainty – mean less competition for talent, reducing the incentive for employers to raise wages. These dynamics will be central to the Fed’s deliberations at its September meeting, making a stronger case for a cut.

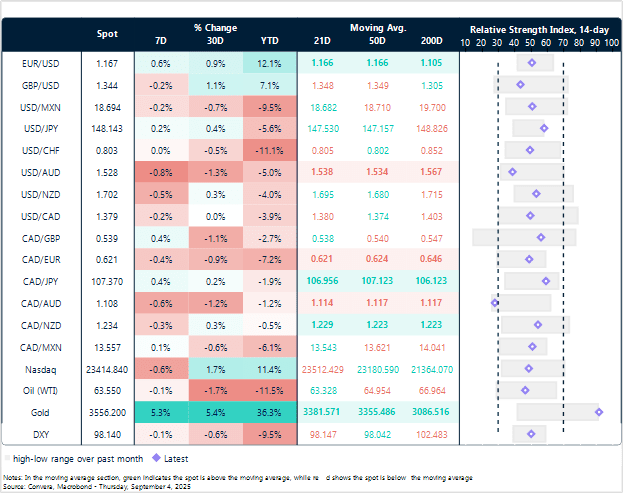

As expected, the dollar weakened, with the dollar index – DXY – falling as much as 0.4% during yesterday’s session before bouncing off support at the 98 level. As we’ve stressed repeatedly, the greenback’s sensitivity to US macro data is at a peak, with investors seeking hard evidence of the economic toll from tariffs to justify further downside in the currency.

Golden lifeline to the Loonie

Kevin Ford

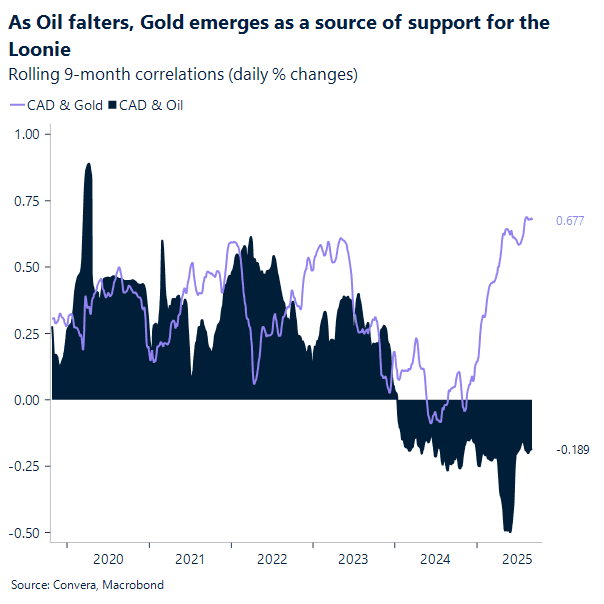

While Canada’s overall exports rose by 0.9% in June 2025, a significant portion of this growth was driven by energy and agri-food products. In contrast, unwrought gold exports actually declined by 5.0% in June, following a strong increase in May. This decrease, particularly in shipments to the United Kingdom, meant that gold’s positive impact on Canada’s trade balance was temporarily muted. Despite this, gold remains a top export, and its strong performance over the first half of the year has provided a valuable, if not always consistent, source of support for the Loonie.

Looking at the full 12-month period leading up to June 2025, gold has been a major and growing part of Canada’s export portfolio. The total value of unwrought gold exports for this period was approximately C$43 billion. This makes gold a consistent top-three export for Canada, with a substantial portion of these shipments, around C$30 billion, destined for the United Kingdom. This strong export performance gives gold a significant share of Canada’s total merchandise exports, which has remained around 6-7% on a consistent basis over the past year. In the context of the broader economy, gold’s contribution to Canada’s nominal GDP is much smaller. With a nominal GDP of approximately C$3.16 trillion as of the second quarter of 2025, the C$43 billion in gold exports represents approximately 1.36% of the country’s GDP. This data highlights that while gold is a high-value commodity, its individual export fluctuations have a limited impact on the broader economic landscape and currency performance compared to larger, more consistent drivers.

Sterling on shaky ground

Antonio Ruggiero

GBP/USD recovered roughly half of Tuesday’s losses as gilts stabilized following the sharp sell-off. Weak US labour market data, however, justified much of the rebound.

The sell-off in bonds is not a UK-specific phenomenon; it reflects broader concerns across major global economies. The UK, however, found itself in the spotlight due to persistently high inflation and stronger-than-expected macroeconomic data, which prompted a hawkish repricing of BoE expectations. In this context, the “higher for longer” rate strategy proved problematic, intensifying the sell-off. Elevated rates place additional pressure on Starmer’s government to meet increasingly urgent self-imposed constraints on public finances.

We believe a dovish repricing – likely not far off – could help ease some of these concerns. That said, this does not imply sterling will emerge as a winner. Markets currently price in only a 40% chance of a rate cut by year-end. This underpricing could lead to more pronounced bearish effects on sterling as repricing unfolds.

We maintain a bearish outlook on sterling. GBP/EUR is eyeing €1.1480 as the next support level to be tested. GBP/USD, meanwhile, remains primarily a USD-driven story. If US data continues to weaken, it could help temper further downside pressure on sterling, providing some short-term upside even. For this week, that would mean breaking north of resistance at $1.35.

Navigating North America’s protectionist turn

Kevin Ford

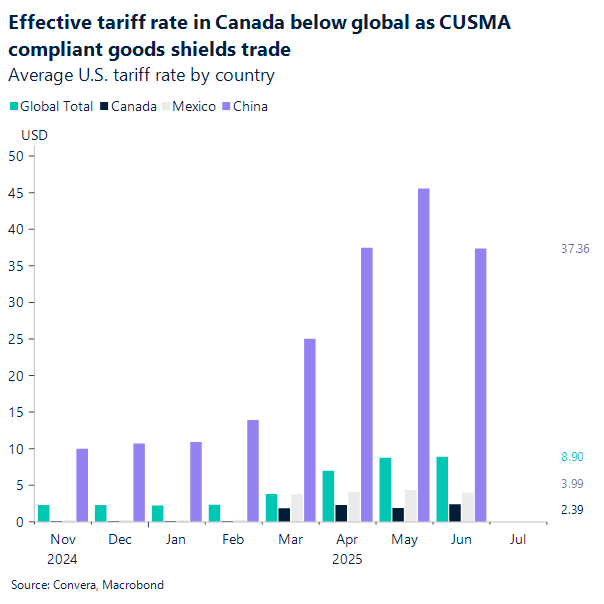

The concept of a “Fortress North America” presents a critical juncture for Canada’s trade strategy. The two central questions are whether a closer alignment with the United States will lead to a shared protectionist agenda, including Mexico, and if failing to align risks Canada’s preferential market access. The nation’s strategic response demonstrates a pragmatic acceptance of this new reality, seeking to secure its position within the more insular regional framework rather than opposing it.

Canada’s actions suggest a deliberate move towards a shared protectionist agenda, albeit one driven by necessity. Following U.S. pressure, Canada has implemented tariffs on Chinese electric vehicles and other products, aligning its trade policy with American goals of protecting domestic industries. This approach is mirrored by Mexico, which has also taken measures to prevent the transshipment of Chinese goods into the North American market. This trilateral coordination signals a shift away from the free-trade principles of the past toward a more protectionist stance against external competitors. This collective effort is not just about adopting U.S. policies; it is about recognizing the shared interest in re-shoring supply chains and strengthening the continent’s economic resilience.

Despite this alignment, Canada is simultaneously engaged in a focused effort to protect its preferential position in the U.S. market. This is evident in the diplomatic exchanges between Prime Minister Mark Carney and President Donald Trump. Prime Minister Carney’s argument about Canada’s “blended tariff rate of about 5.5%,” which he calls “the lowest average tariff of any country in the world,” is a strategic mention. It frames Canada not as a target of U.S. tariffs but as an indispensable partner, demonstrating the unique and valuable nature of their trade relationship. By emphasizing this low tariff rate and by removing its own retaliatory tariffs on goods covered by the USMCA, the Canadian government is working to preserve its access to the U.S. market and differentiate itself from other nations facing more severe U.S. tariffs. Ultimately, Canada’s strategic position is a calculated effort to manage its complex relationship with the U.S., by selectively aligning with the U.S. on issues like Chinese tariffs while rigorously defending its own preferential market access. It is important to note that the majority of trade between Canada and the United States, approximately 92%, remains duty-free. U.S. Census data from earlier in the year showed that a substantial portion of this trade, around 56%, actively complied with the CUSMA rules of origin. This high level of compliance shields a significant amount of key Canadian goods from potential tariffs, providing a critical backstop that guarantees duty-free access for many goods that would otherwise be subject to tariffs.

Safe haven Gold is in overbought territory

Table: Currency trends, trading ranges and technical indicators

Key global risk events

Calendar: September 1-5

All times are in EST.

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.