The energy sector is among those struggling the most to find qualified professionals: 85% of companies in the field report difficulties, a higher share than the information technology industry (84%), long known for its demand for talent. The figures come from a survey by global HR solutions firm ManpowerGroup, which interviewed 1,050 employers across eight industries.

According to six major companies consulted by Valor, the shortage of résumés is being tackled through career development programs, diversity initiatives, and training courses offered in partnership with academic institutions. “One of the biggest concerns of companies is the rapid pace of technological change and the need to constantly update team skills,” said Wilma Dal Col, HR director at ManpowerGroup.

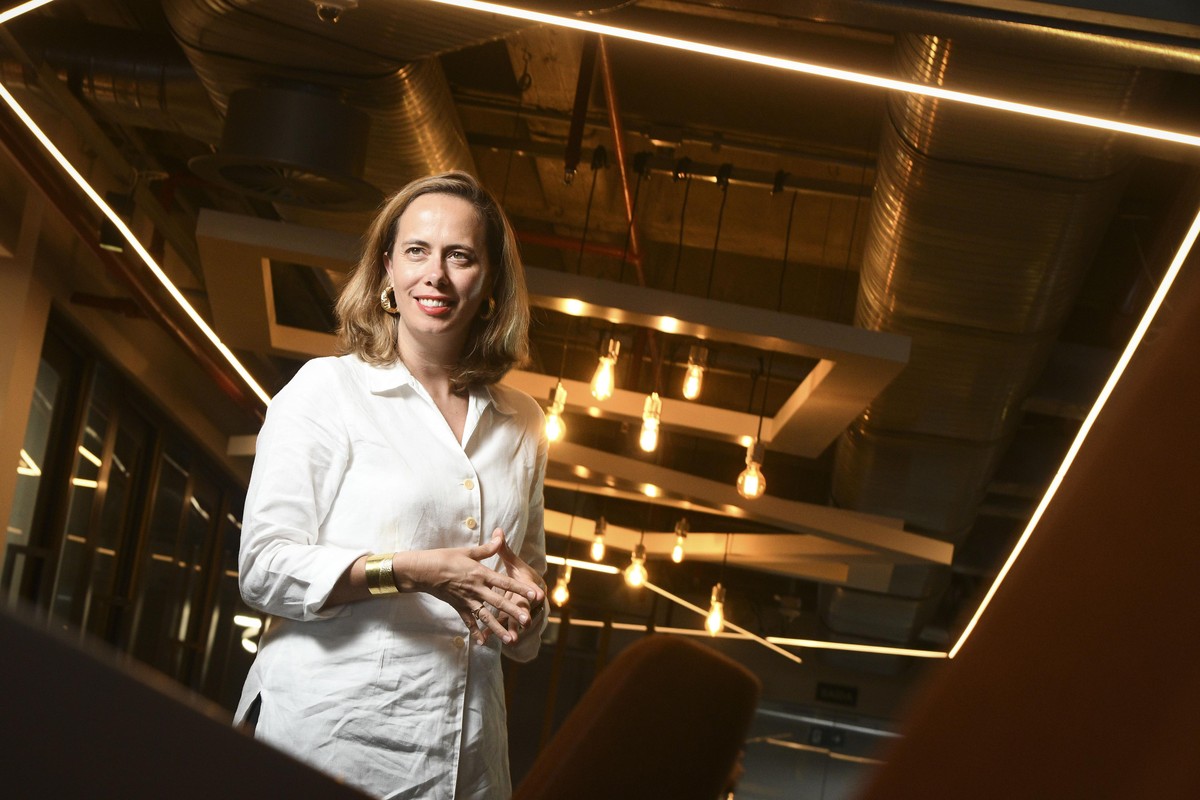

At Engie, which employs more than 3,000 people in Brazil, there were 20 open positions as of late July in states such as Pará and Rio de Janeiro—10% of them leadership roles. “We feel the pressure for qualified professionals, especially in technical and operational areas,” said Sophie Quarré de Verneuil, Engie Brasil’s people and culture director and vice president of HR for Latin America. “The shortage is most evident when we seek profiles in electrotechnics, maintenance and operations, as well as engineers specialized in renewable energy.”

Ms. Verneuil said 42% of open positions are concentrated in engineering, with a focus on projects and automation, followed by operations, renewable asset production, and infrastructure (21%) and field roles such as maintenance and safety (21%). There are also openings in technology (11%), finance and supply chain (5%). In 2024, Engie invested over R$8 million in training, totaling more than 73,000 learning hours, a 15% increase from the previous year.

“We created a trainee program for women to increase female presence in technical areas,” she added. In 2023, all 13 female engineers from the first edition were hired. Last year, 24 positions were opened across Latin America, 12 in Brazil; 21 professionals were selected.

At CPFL Energia, with 16,900 employees, the aim is to address regional labor shortages, especially in areas with fewer technical schools. “We invest in training new talent and reskilling our workforce,” said HR director Renato Povia. The company runs an operational excellence school that has trained more than 18,000 people. Its free electrician training program serves about 700 students per year, with a 75% placement rate within the group. In 2024, training expanded to substation activities and wind power generation. In João Câmara, Rio Grande do Norte, a technical assistant course was designed exclusively for Indigenous communities, producing 19 graduates to work in wind farms.

In July alone, CPFL offered an average of 300 vacancies across São Paulo, Rio Grande do Sul, and the Northeast. Of those, 5% were management roles. In 2023, 94% of leadership positions were filled internally. The company’s corporate university logged 518,100 hours of training in 2024 with 18,200 students. “The results show the effectiveness of investing in people, with an eye on forming future leaders,” Mr. Povia said.

Débora Rangel Celeti, an associate partner at HR consultancy Fesa Group, warned that companies must also address staff turnover. A Fesa survey of 17 power companies showed turnover rising from 13.6% in 2022 to 16.6% in 2024. “It is essential for operations to stop depending solely on external hiring and start investing in building their own talent pipelines,” she said. “Companies with structured career development programs show, on average, up to 30% less turnover.”

Auren Energia is following that path, said Rômulo Vieira, executive director for people, sustainability, technology, and communications. “We have a partnership with Insper to create extension programs, such as ‘Future of Energy,’ offered free to managers,” he said. “Since 2024, about 60 executives have been trained.”

Enel also seeks to strengthen its field teams. “By 2026, we plan to hire 5,000 professionals trained by the company in partnership with Senai,” said Alain Rosolino, HR and organization director at Enel Brasil. By March of this year, 2,100 candidates had been hired in São Paulo, Rio de Janeiro, and Ceará.

At Equatorial Group, which has 12,000 employees, there are around 200 vacancies, fewer than 1% of them management roles. Some technical openings, such as for engineers, have remained unfilled for more than 100 days, illustrating the talent shortage. The group plans to hire 1,400 professionals this year to support operations, grid expansion, and maintenance. “We prioritize grooming successors for leadership roles to ensure cultural continuity,” said HR director Fernanda Sacchi. “Many of our superintendents, directors, and managers began as interns or trainees.” She noted that the group’s trainee programs achieve a 95% retention rate.

At Neoenergia, which operates in 18 states and the Federal District, diversity initiatives are advancing career development. In 2024, the group launched a program dedicated to Black employees. Last year, 18 staff graduated from the program, with four promoted to new roles. “This year, the initiative expanded to 60 participants,” said HR director Fábio Folchetti.

According to Ricardo Simabuku, board member at the Electric Power Trading Chamber (CCEE), employers must recognize talent development as strategically important as technical operations. “Companies should treat workforce training as a strategic dimension,” he said. Over its 26-year history, CCEE has trained more than 30,000 professionals. In June, it launched CCEE Academy, with more than 50 courses, including postgraduate programs designed in partnership with Insper, Fundação Dom Cabral, and the University of São Paulo. “The MBA in risk management and energy trading, developed with USP, is a first in the sector and already moving to its second cohort,” he noted.