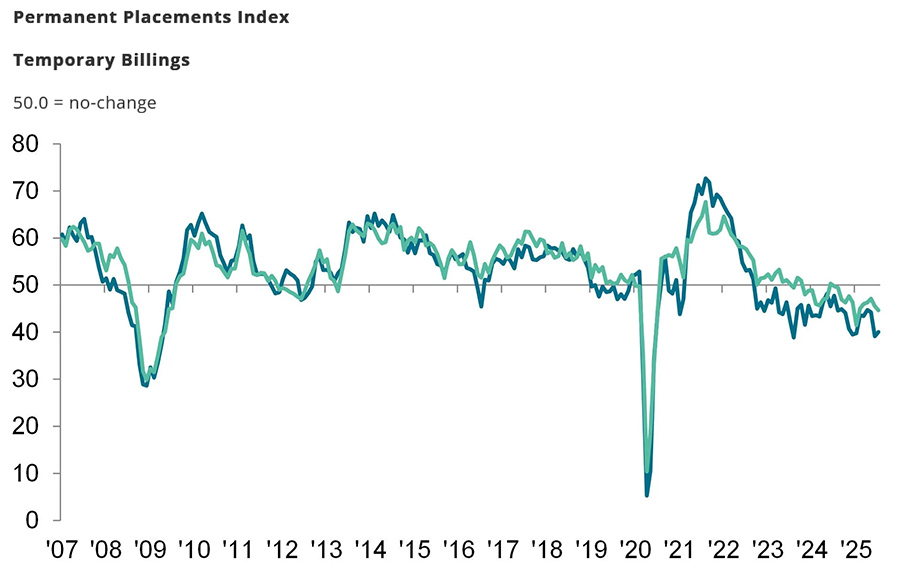

Recruitment activity across the UK continued to fall sharply at the start of the third quarter of 2025, according to a new report. While previous cases of this were attributed to AI taking jobs, the KPMG and REC UK study suggests the drop in permanent placements and temp billings has actually stemmed from weak employer confidence regarding the economic outlook.

The ups and downs of the jobs market have been the source of a great deal of tech-oriented hype/paranoia in recent months. Reports that graduate job intakes had been chopped by as much as 29% in some consulting firms was broadly met with an assumption that this was a reflection of the inevitability of AI, rather than of a challenging period for the sector leading to cost-cutting measures.

A new study from KPMG and REC UK seems to have dispensed with such speculation, though. The fact UK hiring seems to be in steep decline is not attributed to the allegedly undeniable brilliance of machines, but the more conventional results of a looming economic downturn.

Source: KPMG

Analysing the responses to an S&P Global survey, sent to a panel of around 400 UK recruitment and employment consultancies, the researchers found that recruiters frequently mentioned “that hiring activity had fallen due to weak confidence around the economic outlook and greater pressure on budgets due to recent increases in payroll costs.”

Amid this, availability of staff meanwhile rose at “a substantial pace”. In fact, the analysis indicated the proportion rose at its quickest since the survey began in 1997 – something attributed to “redundancies and worries over current job security.” At the same time, there was a steep “reduction in overall vacancies that was the quickest since April.”

Permanent places

Permanent placements fell across all four English regions monitored in the report, for the second month in a row in July. This was steepest in the South of England, led by London, where there was also a broad-based decline in temp billings.

As inflation once again creeps upward, this dampened the growth of salaries to help staff at least keep up with the cost of living. With rising candidate numbers and “increased budget constraints” emerging, pay growth dampened, with starting salaries rising “at the weakest rate in nearly four-and-a-half years.”

The researchers did allude to some of this being linked to AI – but not in the way that commentators were speaking just months ago. Now, the perceived ‘complexities’ of AI implementation – their costly nature, and their high likelihood of failing to actually add value in spite of the hype – mean bosses seem to be looking to recoup losses wracked up by their three-year FOMO binge.

Jon Holt, UK senior partner for KPMG, said, “The labour market cooled in July as chief execs held back from increasing their recruitment budgets. Economic uncertainty, the complexities of AI adoption and global headwinds are all weighing on business planning. A larger talent pool has helped temper wage inflation, which helped convince the Bank of England to cut interest rates. While UK plc remains resilient, a further loosening of monetary policy could help boost business confidence. But many firms will continue to pause major investment decisions until there is greater clarity in the autumn.”